Top Guidelines Of Paul B Insurance

Wiki Article

Getting The Paul B Insurance To Work

Examine on-line testimonials and also rankings of insurance firms prior to choosing, as this will certainly suggest how reputable they are in offering coverage and reacting swiftly when you require assistance. In conclusion, proper organization insurance policy shields a service from losses because of unexpected circumstances. While the cost of costs can appear high, not being sufficiently insured can be tragic.

It is an overwhelming job, recognizing the various kinds of company insurance coverage as well as the defense they supply is an important part of developing a flourishing and also protected organization.

1 Economically Protection: Despite just how a lot you are gaining or just how much you have actually saved; your economic placement can be nicked by an unforeseen occasion in a moment. Consequently, the most effective method to come to be financially safe is to cover on your own, your family, as well as your properties with insurance coverage. You can purchase or renew insurance coverage online and also receive a payout for financial backing, in instance there happens to be an unanticipated occasion.

As an insured, you pay premiums to get payment from the insurance firm, in case of occurrence of an unexpected event. Having insurance reduces the financial concern on your shoulders. 3 Total Security for You and Your Family: Family is the most important asset that you have and your family members relies on you for financial backing.

The 9-Second Trick For Paul B Insurance

5 Some Sorts of Insurance Coverages are Compulsory: Insurance coverage is required because occasionally it is required according to the law (Paul B Insurance). An instance of this is motor insurance. Based on the Car Act of 1988, it is compulsory to contend least a third-party electric motor insurance coverage for every electric motor car layering on road in India.

It offers economic protection to people and services, advertises economic development, and also decreases the worry on the government as well as taxpayers. It is important for people and also companies to analyze their risks and also buy the suitable insurance coverage to guarantee that they are adequately safeguarded in situation of unpredicted events. There are a number of reasons that one should take insurance.

Insurance policy supplies protection versus unexpected occasions that can have substantial monetary consequences. Wellness insurance policy covers medical costs, life insurance policy offers economic assistance to the family in situation of the insurance holder's death, and home insurance coverage covers damages or loss to home.

Nonetheless, if the losses or damages sustained are greater than INR 70 lakh, in such a situation your economic compensation will certainly be restricted to the insurance protection that you have actually gone with, which is INR 70 lakh. As well as if your losses are listed below INR 70 lakh, claim INR 50 lakh, after that you will be compensated as much as INR 50 lakh and also not INR 70 lakh.

Paul B Insurance - Questions

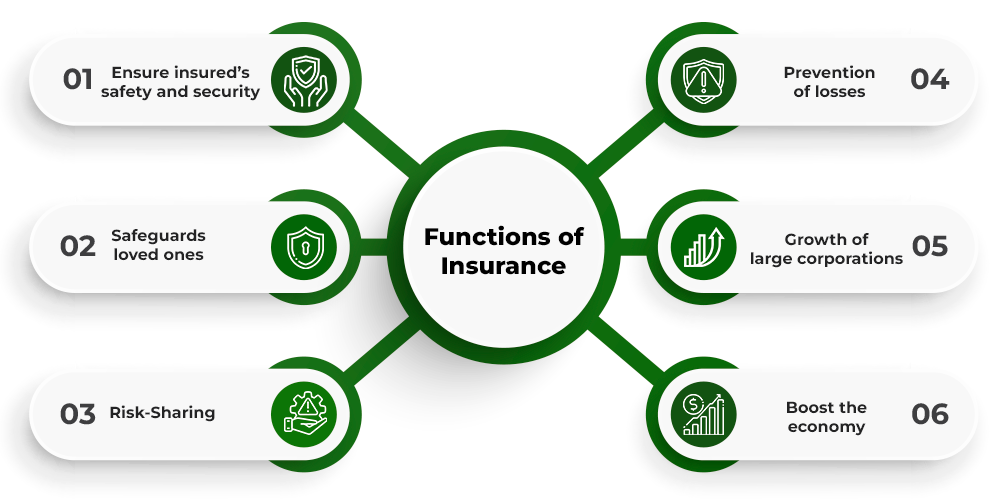

Insurance policy insurance coverage is not simply restricted to the primary insurance holder, yet there are numerous plans which are made to cover your whole family members including your partner, youngsters and also reliant moms and dads as well as brother or sisters. Insurance policy coverage is nothing yet deal with the basis of "danger sharing" and also "threat merging". When one acquisitions any kind of type of insurance coverage from the insurance provider, it is usually being supplied for a specific duration as well as with a particular amount of cover.

When any unfavorable occasion occurs, the insurance policy holder is required to notify the insurance provider as soon as possible with all the called for information. All the losses will be made up by the insurer from the accumulated swimming pool of policyholder's costs based on the pointed out terms of your insurance policy coverage.

Website

In such a situation, the amount guaranteed insurance coverage amount is paid to the insurance holder's nominee, if the insurance policy holder dies within the policy duration.

But, Mr. XYZ has no stress-as he has already taken a vehicle insurance plan from ABC insurance coverage company, which will certainly give complete insurance claim for the damages and hence Mr. XYZ has to spend absolutely nothing from his pocket. There are different sorts of general insurance coverage, such as: There is no uncertainty that insurance coverage functions as a rescuer in any type of kind of regrettable event and bears the loss with you in risky scenarios.

have a peek at this website

The 5-Minute Rule for Paul B Insurance

Following time when you are planning to assess your economic profile as well as realize that you are still uninsured, make sure that you establish apart at the very least some funds for the appropriate kind of insurance coverage.

Read More Here

Insurance coverage is a legal contract in between two events the insurance provider and also the insured, additionally known as insurance policy coverage or insurance coverage. The insurance firm offers economic coverage for the losses of the insured that s/he might birth under certain scenarios. Allow's talk about carefully what is insurance as well as exactly how it functions, the insurance benefits, as well as kinds.

Premium repayment makes a decision the ensured sum for insurance coverage or 'policy limitation'. Occasionally when you make an insurance case, the costs quantity is much less than what it should be. So, in that situation, you first need to pay the continuing to be quantity and afterwards claim the insurance money. The added quantity to be paid under such circumstances is called 'deductible'.

Insurance coverage has the listed below discussed prominent attributes: It is a kind of threat administration strategy to make use of an insurance plan as a bush against an unpredictable loss, Insurance policy insurance coverage does not mitigate the magnitude of loss one might deal with. It only ensures that the loss is shared as well as dispersed amongst several individuals, Numerous customers of an insurance provider pool in their threats.

Fascination About Paul B Insurance

The basic functions of insurance policy coverage are: Insurance protection does lower the influence of loss that one bears in dangerous circumstances. It not just safeguards the guaranteed from economic concerns yet likewise assists in inspecting mental stress and anxiety emerging out of it.

The insured pays a small portion of the revenue for this assurance that will certainly help in the future. So, there is a certainty of handsome financial assistance versus the premium. It will protect the policy purchaser when consulted with accidents, dangers, or any vulnerabilities. The actual manner in which insurance coverage operates makes it a participating scheme.

An insurer pools in cumulative threats and also costs due to the fact that it covers a lot of risk-exposed individuals. The payment to the one who asserts insurance policy protection is out of this fund. Therefore, all policyholders share the risk of the one who really endured the loss. Insurance coverage policy assesses the quantity of risk as well as likewise expects the different reasons for it.

Report this wiki page